|

|

|

Baldly Going Where We’ve Never Gone Before

Bald-Faced Lies Regarding Collapsing Global Demand

If I had a nickel for every time I’ve heard how reduced domestic U.S. demand for commodities was going to spell the end for Global Demand – I’d be rich already. In particular, over the past few months, the main stream financial press has been trumpeting that the real reason for prices of commodities being hammered into the ground is sagging Global Demand.

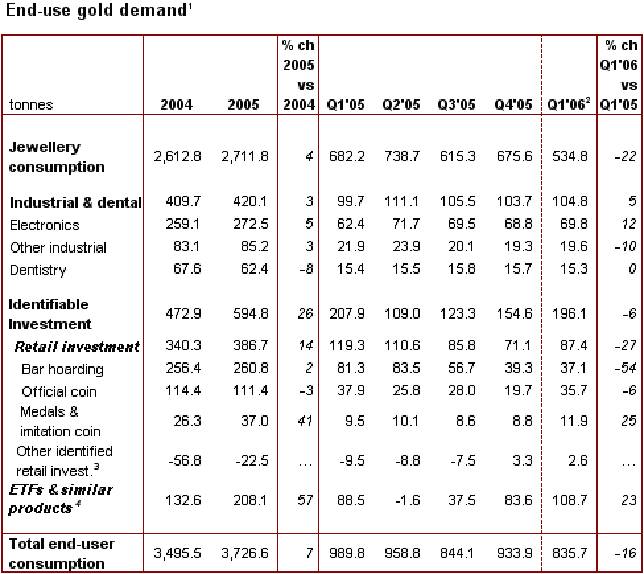

We can empirically see what a load of crap that’s turning out to be:

China Boosts Oil Imports to Record on Falling Prices

http://www.bloomberg.com/apps/news?pid=email_en&refer=china&sid=aku3hyO64O9M

Oct. 13 (Bloomberg) -- China, the world's second-largest energy user, increased crude-oil imports to a record last month, taking advantage of falling prices, as domestic refining capacity climbed.

Crude imports surged 46 percent to 20 million metric tons or 4.87 million barrels a day in September from a year earlier, according to Bloomberg's calculations based on figures provided by the Beijing-based Customs General Administration of China on its Web site today. August purchases were 15.65 million tons…..

[more.....signup] [open pdf....members] |

The Fall Rollout

With the Olympics better than half over and political season expected to shift into high gear with the commencement of the Democratic National Convention in Denver on Aug. 25, 2008 followed by the Republicans [Minneapolis-Saint Paul, September 1-4, 2008] - we can soon expect fall “roll outs” to begin making headlines.

Post Labor Day marks the count-down to the end of the current fiscal year [Sept. 30] in the U.S. and signifies the beginning of new seasons in everything from academics to advertising to the aforementioned politics – especially in a presidential election year.

[more.....signup] [open pdf....members] |

Fast Blast Gulf Coast Macro Energy Update

The extent of damages to America’s Gulf of Mexico energy infrastructure - have been grossly and egregiously under-reported. One can only posit that the true reason[s] for this had something to do with officialdom’s desire to maintain the illusion that “all is well” and exemplifies the lengths they will go to – to prevent stories of “shortages” and rising prices [inflation] from appearing in the mainstream media. [more.....signup] [open pdf....members] |

The Impending Receivership of the U.S.A.

My, how times have changed? As Bloomberg News reported Tuesday, September 24, 2008,

Eighteen months ago, U.S. Treasury Secretary Henry Paulson told an audience at the Shanghai Futures Exchange that China risked trillions of dollars in lost economic potential unless it freed up its capital markets.

``An open, competitive, and liberalized financial market can effectively allocate scarce resources in a manner that promotes stability and prosperity far better than governmental intervention,'' Paulson said.

Suddenly, it’s now become blindingly evident that “what’s good for the goose isn’t regarded as being so good for the gander”. It is exactly these types of conflicted pronouncements that hint at the true nature of what really afflicts America – treasonous deceit.

Portrait of a Financial Coup d’Etat

There’s been a growing consensus that the financial quagmire the U.S. is currently facing is wholly the result of the sub-prime / credit default swap [derivatives] issues plaguing financial institutions.

[more.....signup] [open pdf....members] |

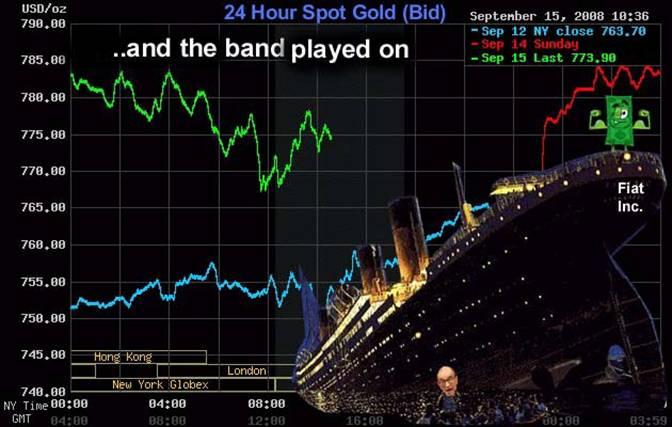

And the Band Played On

To say that events that unfolded in the world’s financial markets last week were ‘unprecedented’ is perhaps a little too cliche. So let us revisit some of the key events which reportedly unfolded in the wake of Lehman’s demise – a fate that was sealed last weekend [Sept. 13 / 14] when last attempts to rescue the storied U.S. Investment Bank hit-the-rocks [or ice, perhaps?].

Lehman’s Demise Was Most Assuredly All-About J.P. Morgan

First off, I found it perversely odd that there were allegedly serious suitors who got to take a peak at the state of Lehman’s finances. Institutions rumored to be involved were Korea Exchange Bank, Barclays and B of A. What stuck in my craw was the widely publicized revelation that, [more.....signup] [open pdf....members] |

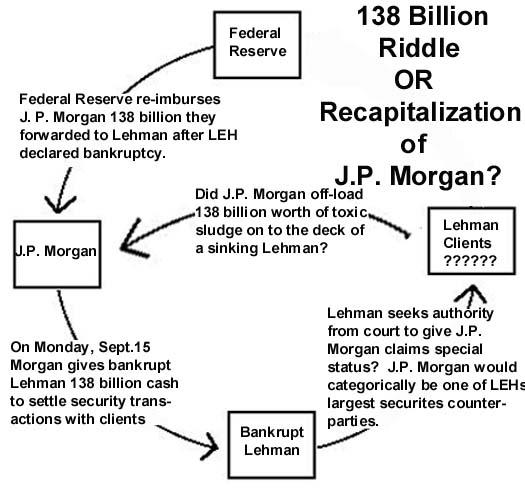

Special Status and the $138 Billion Riddle

(pdf version for members)

We are living in heady times. On Monday morning, something VERY strange occurred:

$138 Billion Post-Bankruptcy JP Morgan Advance to Lehman; At Least $87 B Repaid by Fed

Twp readers, Steve and Julian e-mailed us about the Bloomberg story below, that the Fed repaid JP Morgan for an advance made to Lehman after its bankruptcy filing:

Lehman Brothers Holdings Inc., the securities firm that filed the biggest bankruptcy in history yesterday, was advanced $138 billion this week by JPMorgan Chase & Co. to settle Lehman trades and keep financial markets stable, according to a court filing.

One advance of $87 billion was made on Sept. 15 after the pre-dawn filing, and another of $51 billion was made the following day, according to a bankruptcy court documents posted today. Both were made to settle securities transactions with customers of Lehman and its clearance parties, the filings said.

The advances were necessary ``to avoid a disruption of the financial markets,'' Lehman said in the filing.

The first advance was repaid by the Federal Reserve Bank of New York, Lehman said. The bank didn't say if the second amount was repaid. Both advances were ``guaranteed by Lehman'' through collateral of the firm's holding company, the filing said. The advances were made at the request of Lehman and the Federal Reserve, according to the filing.

Lehman disclosed the advances in a motion seeking court permission to give JPMorgan's claims special status in its attempts to recover any advances. Lehman said that if that status isn't granted, JPMorgan may not be able to make future advances needed to clear and settle trades.

``The granting of the relief requested is in the best interests of the estate and its stakeholders and the public markets,'' Lehman said, adding the advances would be ``essential to Lehman's customers.''

JPMorgan may make future advances at its sole discretion, all of which would be guaranteed by Lehman under its agreement to pledge collateral, Lehman said.

JPMorgan said in a statement in court documents that it has had a clearing agreement with Lehman since June 2000, and had pledged its collateral under an Aug. 26 guarantee.

Since the Federal Reserve reimbursed J.P. Morgan, presumably and ostensibly, with public monies [that taxpayers will be on the hook for] – doesn’t the public have the right to know what that 138 billion was spent on?

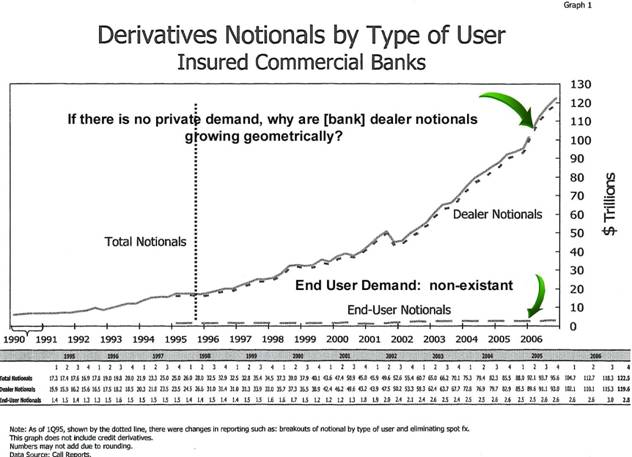

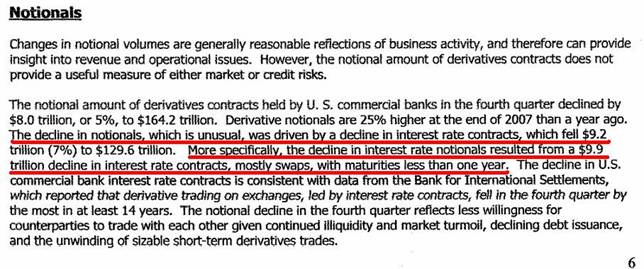

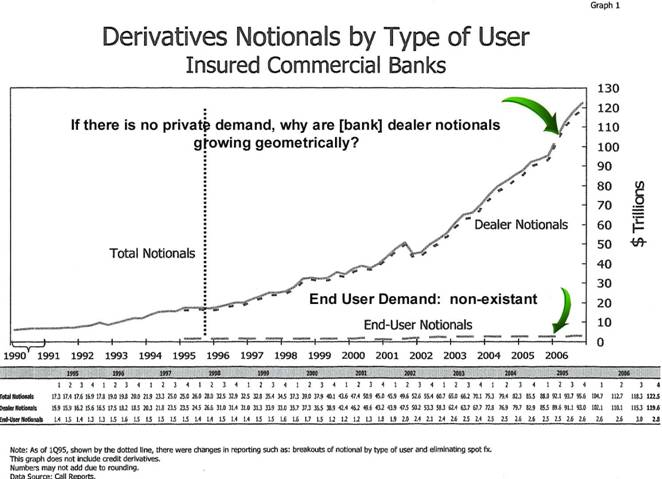

Investment banks are dropping like flies, owing to their involvement in credit derivatives – this is a fact.

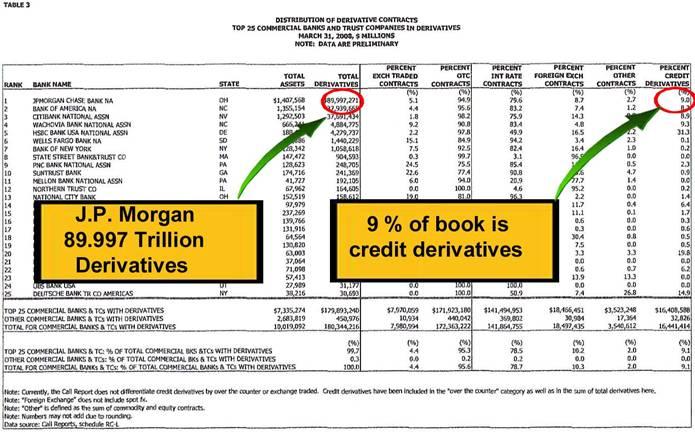

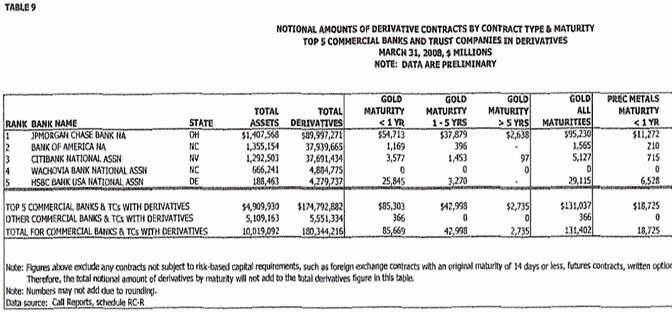

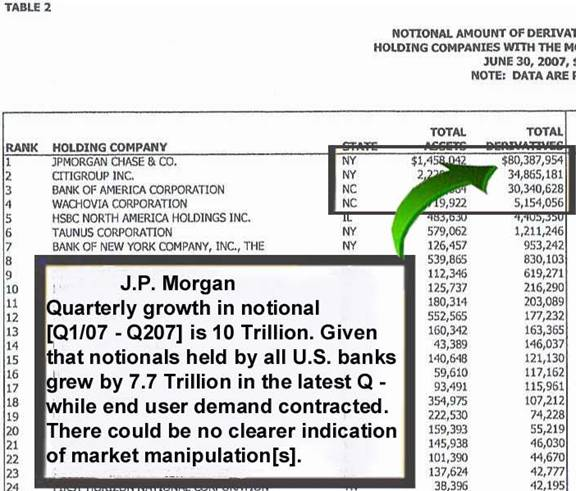

J. P. Morgan is – HANDS DOWN – the largest derivatives player in the world with a book of 90 Trillion in notional value at March 31, 2008 – with 9% of the book composed of Credit Derivatives. That amounts to a cool 8.1 Trillion worth of Credit Derivatives. We know this from the Office of the Comptroller of the Currency’s Quarterly Derivatives Report – pg. 24

Wouldn’t you suppose that would be enough to bury any institution?

Who knows, maybe it did. We only learned about the 138 billion advance from a court document where Lehman was seeking to give claims of J.P. Morgan “special status”.

I must admit, this looks special indeed:

|

Treachery Abounds: Setting the Record Straight

(pdf version for members)

Surveying the landscape, here’s an overview of what I’m seeing:

Decoupling Fact from Fictional Futures

In Bill Murphy’s daily commentary at LeMetropolecafe.com, Friday September 12, Murphy reported this account from one of his subscribers who happens to be in the metals recovery business:

“I have to admit Bill I have seen a lot in my time but if this information I am about to provide you doesn't prove once and for all that these markets are being totally manipulated and distorted. Then there will be nothing left to prove anymore about anything.

I have been recycling for over 10 years now and I have been focused in developing a service in the silver recovery business.

So far it's been very successful and I had been preparing an order for recovery just before they hit the silver market.

I was sitting on 29 skids @ 28,000 lbs

of fiche which equates to aprox. 385 lbs

of pure silver considering my assay on

this grade of fiche was very high.

1.4 grams per 1000 grams of micro fiche.

It's around 4 dollars per lb or 6000 ounces

of silver.

Now, I won't mention names but I was unable to setup a bullion account with this company because they don't setup accounts anymore so I can't hedge the market.

The day you deliver. You get paid spot on the Comex.

So I simply parked my product and waited. Now talk about a squeeze play. Would you believe that this company called me today [Friday] @ 10.50 silver and quoted me 16.00 per ounce with room to negotiate??? “

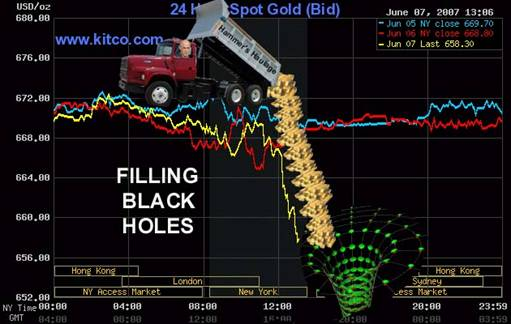

This account perfectly illustrates what we are witnessing, first hand; as physical stocks become more and more scarce – the Cartel is “beating the COMEX price with a stick” – making would-be-buyers think twice before putting their money down [or order in] for the real thing.

This cripples all resource companies since they ALL contract to have their off-take benchmarked against fraudulently derived paper futures prices.

This is why we currently give preference to ownership of physical metal versus mining shares.

This also provides a great backdrop for talking heads to say “commodities are toast” – lessening demand for physical or forcing liquidation through [cough] the etfs – GLD and SLV. I distrust the etfs on the basis that their alleged stocks of physical are all under the custody and direct control of institutions [the Cartel] long suspected / accused of price management of the same.

In the end, however, smart money the world over – has now cotton on to this charade. I speak quite regularly with folks around the world – there simply is NO PHYSICAL SILVER to be had – virtually anywhere.

I would like to share with you all an interaction I had with GATA’s Bill Murphy approximately 3 years ago: I remember Murphy explaining to me,

“if GATA is correct, physical metal was the Achilles Heel of the Cartel. Regarding shortages – if the GATA thesis is correct - they should categorically appear first in silver, then gold.”

So, despite the blatant pummeling of the paper commodities complex [futures], artificially lowering prices in the face of shortages WILL NOT RESOLVE CURRENT PROBLEMS, and in fact, will intensify them.

So, while these are trying times in the commodities space – they should surprise no-one.

The painful declines we are experiencing have been “linear”. The advances, I would suggest, are going to be GEOMETRIC.

When this reality sinks in universally, it will not only discredit the COMEX but all futures markets will be seen for what they are – frauds – and highly inappropriate as honest price discovery mechanisms.

The futures markets are, collectively, the basis or underpinning of the 1.25 quadrillion Derivatives Complex.

It has been the unrelenting price management of strategic commodities and distortion / falsification of economic reporting which would expose the rigging that has brought on the plethora of economic horrors which have led to the COMPLETE SYSTEMIC FINANCIAL MELTDOWN we are now just beginning to experience.

Bank of America Doing Deals That Don’t Pass the Smell Test

I’m extremely dubious of B of A’s involvement with ML, not to mention Country Wide, given their dubious involvement in such scams as BCCI [Bank of Crooks and Criminals]:

http://www.copi.com/defrauding_america/chp_23.htm

COVERUP OF THE BANK OF CROOKS AND CRIMINALS

Millions of people throughout the world lost billions of dollars, made possible by the coverup actions of people in foreign countries and in the United States. These losses would not have occurred had officials and attorneys in the United States not engaged in the crimes of coverup misprision of felonies, obstruction of justice, and had they not aided and abetted the criminal activities. Congressional committees, Justice Department personnel, the FBI, and the CIA, all knew about the corrupt operation for years.

SOURCE OF STARTUP FUNDING

BCCI commenced operations in Pakistan in 1972, with much of its funding provided by Bank of America and the CIA.(372) Bank of America claims that it sold its BCCI interest in the early 1980s, but records show that Bank of America continued to control much of BCCI's operation until shortly before BCCI was shut down. In the early 1970s CIA operative Gunther Russbacher transferred sizeable amounts of CIA funds into the bank for the start-up operations.

MADE TO ORDER FOR CIA ACTIVITIES

The CIA knew about BCCI's activities, finding this mindset suitable to its own operations. If, for argument, the CIA was not in partners with the BCCI activities, its world-wide network of operatives and assets should have discovered the BCCI activities that brought about the world's worst banking loss. BCCI was custom-made for the covert and corrupt activities of the CIA, the Mossad, drug dealers, and terrorists. My CIA contacts, including Russbacher, described how CIA operatives used the bank to launder money from CIA enterprises, including drug trafficking proceeds, money from its various financial activities within the United States, including its looting of savings and loans, to fund unlawful arms shipments, finance terrorist operations,(373) undermine foreign governments, and other covert activities.

Three years before the BCCI scandal broke, Robert Gates, Deputy Director of Intelligence Operations at the CIA, stated to another CIA official that BCCI stood for the Bank of Crooks and Criminals!

Both the Country Wide deal and the ML deal seem like “fronts” with B of A catching falling daggers in both instances paying huge premiums for major players on their way to bankruptcy in markets that are getting crushed!!

These deals have that familiar squalid Enron-esque stench emanating from them.

I would suggest that all they’ve really done is to buy a little more time – days perhaps?

B of A CEO, Ken Lewis, Openly Contradicts “Pinocchio” Paulson

Interesting thing I noticed today, when B of A CEO - Ken Lewis – appeared at a televised press conference with ML CEO – John Thain: Lewis emphatically stated that regulators had not coerced or “arranged” their shot-gun-marriage. Lewis stated that the deal was done of his and Thain’s own volition.

Fast forward a couple of hours and Pinocchio Paulson is stating how pleased he is that Fed and SEC managed to bring major market players together over the weekend.

These clowns are contradicting themselves.

Good grief, they can’t even sleaze properly.

Prepare For Energy Shortages

All the talk that Ike had not affect the energy complex in the Gulf seem to be pre-mature and no doubt played-up as cover for the “fire bombing” of the energy futures.

http://uk.reuters.com/article/governmentFilingsNews/idUKN1542617320080915

Henry Hub operator says force majeure remains

NEW YORK, Sept 15 (Reuters) - The operator of the Henry Hub, the benchmark trading point for New York Mercantile Exchange gas futures, said Monday it was assessing the status of the Hub and facilities on its mainline natural gas system, but force majeure declared over the weekend remained in effect until further notice.

In addition, Sabine Pipe Line LLC said in a website posting initial reports indicated flooding from Hurricane Ike had impacted the current operability of its system.

Sabine is the owner / operator of Henry Hub. The Henry Hub offers shippers access to pipelines that have markets in the Midwest, Northeast, Southeast and Gulf Coast regions of the United States. The Henry Hub interconnects with nine interstate and four intrastate pipelines including the following: Acadian, Columbia Gulf, Gulf South Pipeline, Bridgeline, NGPL, Sea Robin, Southern, Texas Gas, Transco, Trunkline, Jefferson Island, and Sabine's mainline. Sabine's two compressor stations at the Hub provide the operational flexibility to compress 520,000 Dt/d and make any necessary deliveries to high-pressure pipelines. Sabine currently possesses the ability to transport 1.8 Bcf/d across the Henry Hub.

The likelihood of spot energy shortages [refined product and Nat. Gas] are growing by the day.

The Dollar Rally Sham

Dr. Jim Willie recently reported that U.S. Dollar denominated bonds are likely being “called in”:

“In all likelihood the Bank For International Settlements in Basel Switzerland ordered the United States to call in USTreasurys and USAgencys, the bond instruments, the financial weapons of mass destruction. The BIS ordered the financial leadership to call their damaged risky debt securities home, so that they can explode on US soil, so that their greatest concentration rests on US soil, so that the maximum loss occurs to US institutions, so that the risk can be kept to a practical minimum for foreign nations. The benefits given to Americans are two-fold, one a bizarre paradox, the other an open door to steal.”

I concur with Dr. Willie assessment. It stands out in my mind that this past weekend’s Wall Street restructuring involved ZERO FOREIGN PARTICIPATION. Barclays, who had been rumored to be in the mix to save Lehman walked away from the table. Korean money, earlier last week, did the same thing.

|

To: Ontario Securities Commission

20 Queen Street West, Suite 1903

Toronto, ON M5H 3S8

Attn: PUBLIC INQUIRIES AND INVESTOR COMPLAINTS

Dear Sir or Madame;

My name is Rob Kirby, proprietor of Kirbyanalytics.com. I would like to know if the Ontario Securities Commission has any public comment regarding the public utterances for Don Coxe of the Bank of Montreal’s Harris Bank unit in his weekly web cast, for institutional clients of the bank, dated Sept. 5, 2008.

In case you have not heard or seen Mr. Coxe’s comments, the title of his presentation was:

“And Hank And Ben Looked At Their Handiwork And They Were Glad.”

He goes on to state,

[more.....signup] [open pdf....members]

UPDATE:

Follow Up To Rob Kirby Enquiry to OSC

Re: PUBLIC INQUIRIES AND INVESTOR COMPLAINTS - Ontario Securities Commission

Mr. Jeff Fennell;

Thank you for your prompt response to my enquiry and concern. I take issue with some of your comments.

Both Mr. Heinzl and I are commentators on financial markets.

Mr. Coxe is an acknowledged and pedigreed, senior officer with the Bank of Montreal – one of Canada’s largest banks. He is further the name sponsor [via BMO] of a “so named commodity fund” listed on the Toronto Stock Exchange.

[more.....signup] [open pdf....members] |

The Stars Are Aligning – But For What?

(pdf version for members)

Fannie and Freddie were finally nationalized on Sunday, September 7, 2008 – a date that may very well live in infamy. Shareholders of the mortgage behemoth mortgage giants have been effectively wiped out.

By Glenn Somerville and Mark Felsenthal

WASHINGTON (Reuters) - The U.S. government on Sunday seized control of mortgage finance companies Fannie Mae and Freddie Mac in an aggressive move to help the distressed U.S. housing market and economy.

Officials were concerned mounting losses at the two companies, which own or guarantee almost half of the country's $12 trillion in outstanding home mortgage debt, was sapping their vitality and threatening to undermine them at a time other sources of housing finance have largely run dry.

"Our economy and our markets will not recover until the bulk of this housing correction is behind us," Treasury Secretary Henry Paulson said at a news conference. "Fannie Mae and Freddie Mac are critical to turning the corner on housing.”

The decision to take control of the companies, which have $1.6 trillion in debt outstanding, and place them into a conservatorship under their regulator could amount to the largest financial bailout in U.S. history. The Treasury Department, which is taking an equity stake in the two firms, said there was no reason to expect that taxpayers would have to shoulder losses.

Folks should appreciate and understand that the Fannie / Freddie bailout are being conducted with the resources of the U.S. Treasury and not the Federal Reserve. The Federal Reserve’s balance sheet simply would not allow it.

Ladies and gentlemen, I would contend that the U.S. Treasury’s balance sheet cannot either.

The Back Drop For Context

In what many folks might disregard as an unimportant revelation, the Bank of Montreal’s Don Coxe provided in his weekly web-cast, to the bank’s institutional and private banking clients, a telling descriptive [transcript available here] of recent market events where he lays out how the Federal Reserve and the U.S. Treasury in conjunction with the CFTC and SEC “RIGGED” the recent collapse in commodities complex and the accompanying bounce in financials to purposely destroy people who were making commodity bets and shorting financials.

Coxe’s presentation is titled,

“And Hank And Ben Looked At Their Handiwork And They Were Glad.”

He goes on to state,

“So, let’s talk about this, what they did, why they did it and how brilliantly they did it, because this is the most massive intervention of government into the capital markets or the financial system since Roosevelt closed the banks back in 1933, briefly.”

Coxe goes on to explain,

“So what they did – and this is why you want in a crisis like this, you want a Goldman Sachs ex-CEO at work. People sometimes sneer about the fact that Goldman seems to just get all these big appointments. But what it means is you’ve not only got somebody that really knows the markets, but somebody who’s access to information is terrific and who really understands how you can intervene in the markets successfully. Because if you’re going to do a strategy like this, it’s got to work.”

The unintended beauty [sic] of Cox’s words is that they “drip” with nuance illustrating the incestuous relationship between the Federal Reserve / Treasury and one of their favorite private sector agent / provocateurs - Goldman Sachs.

This space has extensively documented the role of both Goldman Sachs [primarily in the investment banking / commodities space] and J.P. Morgan Chase [primarily in the commercial banking / interest rate complex] and their use as “TOOLS” to implement Federal Reserve Monetary Policy via stealth – all the while trying to maintain the illusion of “free markets”.

If my read on these goings-on is only half correct, this grand stage illusion of a charade is about to come to an end.

Our capital markets have been grossly manipulated and rigged. Regulators have been complicit. For those of you who have no problem with this, I would now like you to consider existing U.S. anti-trust laws:

The Sherman Antitrust Act is a Federal law prohibiting any contract, trust, or conspiracy in restraint of interstate or foreign trade.

The Sherman Act also provides that no person shall monopolize, attempt to monopolize or conspire with another to monopolize interstate or foreign trade or commerce.

A felony, an individual violating these laws may be jailed for up to three years and fined up to $350,000 per violation. Corporations may be fined up to $10 million per violation.

The Clayton Act regulates general practices that potentially may be detrimental to fair competition. Some of these general practices regulated by the Clayton Act are: price discrimination; exclusive dealing contracts, tying agreements, or requirement contracts; mergers and acquisitions; and interlocking directorates.

To imagine: I was always taught – growing up - that America was a country where the rule of law meant something.

Connecting Dots

The factual picture I’m painting here is that something egregiously, horribly wrong is occurring right now, under our collective noses, in our financial markets. I’m left with a sinking feeling that things are coming to a head, so to speak and all that’s been missing is to this picture is the exact timing of the culmination.

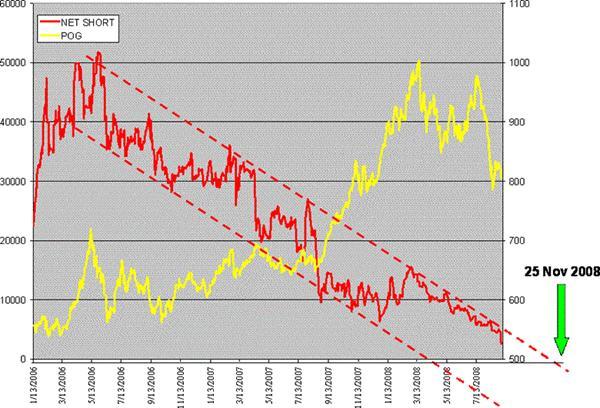

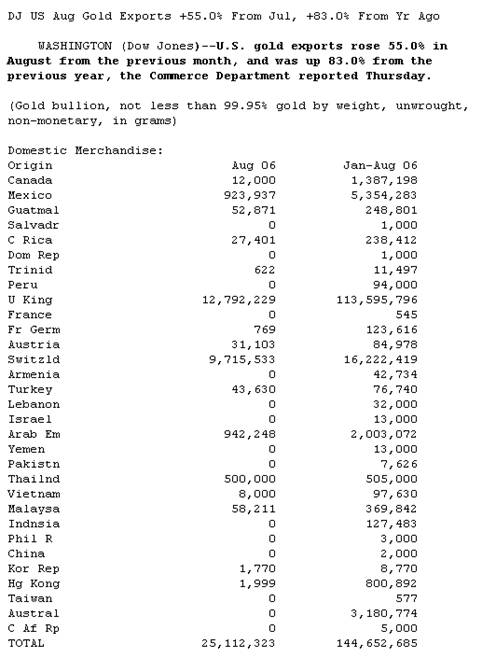

Speculating as to what this culminating event might be is the topic of an in-depth report for subscribers is being prepared for publication at Kirbyanalytics.com – explaining the mystifying recent dollar and bond rally, shortages of physical precious metals and the decoupling of the COMEX [futures] price of gold and price to acquire physical metal, and what to do next. The timing, however, I now believe is very closely tied to this; illustrated by the work of Adrian Douglas, GATA consultant and frequent contributor to LeMetropolecafe.com:

September 2 session on the TOCOM Goldman Sachs COVERED an absolutely stunning 1,612 short contracts AND ADDED 351 LONG CONTRACTS to bring their long position to 1,049 contracts (a 50% increase in one session!!!!) and their net short position to 2,537 contracts (a 44% reduction in one session!!!). This is a NEW RECORD LOW for their net short position but beats the previous low by 1,963 contracts! This has absolutely astonishing implications for the gold market. GS is running for the hills. Clearly the gold market is headed MUCH higher.

The activities of Goldman Sachs “shorting gold” on TOCOM [Tokyo Commodities Exchange] was first brought to my attention by Adrian Douglas via Bill Murphy’s daily Midas commentary at Lemetropolecafe.com. on Jan.10, 2006. Douglas has reported on Goldman’s daily TOCOM gold futures position changes for almost 3 years.

With Goldman Sachs representing a defacto surrogate of the Federal Reserve – it is clear that the Fed is moving from being “overextended short” to flat – or possibly going long gold.

I believe this transition is critically important – much like a fuse burning toward explosives.

When this position crosses over from short to long, as I expect it will sometime this month – I expect that some large deafening bells will be ringing – somewhere.

Those bells might possibly be ringing first at Fort Knox, Kentucky or West Point, N.Y., where much of the U.S. sovereign stock [8,150 metric tonnes] of gold is alleged to be stored – but has never been independently [third party] audited since the Eisenhower administration.

I hope everyone has secured their own personal cache of physical gold already.

Subscribe here |

Jim Willie, whom I speak with and exchange views with on a very regular basis, sent me the article appended below and asked me to give him my take on it in as few words as possible. My comments are in red. Thought you might all find some benefit in this.

New Credit Hurdle Looms for Banks

By CARRICK MOLLENKAMP

August 27, 2008; Page A1

U.S. and European banks, already burdened by losses and concerns about their financial health, face a new challenge: paying off hundreds of billions of dollars of debt coming due.

At issue are so-called floating-rate notes -- securities used heavily by banks in 2006 to borrow money. A big chunk of those notes, which typically mature in two years, will come due over the next year or so, at a time when banks are struggling to raise fresh funds. That's forcing banks to sell assets, compete heavily for deposits and issue expensive new debt.

[more.....signup] [open pdf....members] |

Wake-Up Call

Last week, widely regarded silver analyst, Ted Butler, reported on recent developments during the July 1 – August 5, 2008 time period in the precious metals complex [specifically, open-interest data in COMEX futures].

Butler’s work shows; As of July 1, 2008, two U.S. banks were short 6,199 contracts of COMEX silver (30,995,000 ounces). As of August 5, 2008, two U.S. banks were short 33,805 contracts of COMEX silver (169,025,000 ounces), an increase of more than five-fold. This is the largest such position by U.S. banks I can find in the data, ever. Between July 14 and August 15th, the price of COMEX silver declined from a peak high of $19.55 (basis September) to a low of $12.22 for a decline of 38%.

[more.....signup] [open pdf....members] |

M3 Reporting and the Monetary Base

(pdf version for members)

Recent research I’ve conducted and presented has led me to the inescapable conclusion that there are some SERIOUS macro incongruities in the Fixed Income [Bond] complex:

- I first broached this subject in Pirates of the Caribbean, where I dispelled the [then] popular myth that Caribbean based Hedge Funds were gobbling up unexplainable amounts of U.S. Government Debt. The reality is they couldn’t have.

- In The Elephant In the Room, presented at GATA’s Washington conference in the spring of 08, I documented how J.P. Morgan was seen to be conducting ‘massive’ trade in U.S. Government Securities that legally cannot exist.

- In Dead and Buried, But Not Forgotten, I highlighted the reporting of Daniel Gros showing, “The global financial system seems to have a black hole at its centre. Over the last two decades, US residents have sold a total of about $5,500bn worth of IOUs to foreigners, yet the officially recorded net investment position of the US has deteriorated only by a little more than half of this amount ($2,800bn). The US capital market seems to have acted like a black hole for investors from the rest of world in which $2,700bn vanished from sight - or at least from the official statistics.”

- In Dead and Buried, I then connected the dots between the possibility of securities and collateral fraud and 9-11.

The revelations in the Gros article are highly suggestive that some SERIOUS MONKEY BUSINESS has occurred with the monetary base; namely, that a stack of bonds have been/were bought [result of foreign revulsion of U.S. debt in the wake of LTCM perhaps?], or monetized if you prefer [likely through J.P. Morgan’s absurd 93 Trillion derivatives book], and the fiat money that was printed out of thin air to ‘redeem them’. These newly created balances were NEVER recorded in official statistics or M3 reporting [as the Gros article suggests] – because acknowledging their existence would be akin to admitting that foreigners had lost faith in U.S. Government Bonds.

Ladies and gentlemen, bonds DO NOT DISAPPEAR, get misplaced, or otherwise get lost in black holes - period.

This view, coincidentally, would go a long way to explaining why the Fed stopped reporting M3 Money Supply Aggregates on March 26, 2006. Could it be that the Fed was really concerned that continued reporting of M3 would have been reverse engineered by someone like John Williams revealing that bonds or debt outstanding does not equal money in circulation?

Making the amount of money in circulation look smaller – in the face of deliberate, wholesale money printing – would make fiat money appear relatively more attractive.

Who would benefit from such an act?

Published monetary aggregate data is perhaps more laughable than bogus published reports that inflation is running at 2 – 4 % levels.

For those of you naive enough to think that a Central Bank would not commit such an act, please

consider the words of Dallas Fed President Richard Fisher,

"The Federal Reserve will do what it takes to maintain its credibility, which is central to preserving the integrity of the US dollar," Dallas Federal Reserve Bank President Richard Fisher said on Tuesday.

This report, from Reuters, continues: "We seek to get it right. And the answer to your

question is we will do what gets it right," said Fisher.

Answering audience questions after a speech to the Dallas Friday Group, Fisher said the US dollar is a "faith-based currency" dependent on the credibility of a central bank.

"In addition to a faith-based currency, we are the currency of the world and we must maintain its integrity..."

Well……………..have they?

In the Fall Rollout, now posted at Kirbyanalytics.com, subscribers are reading a comprehensive 12 page report dealing with thought provoking macro analysis on geopolitical issues, pratfalls of technical analysis, derivatives, Fannie Mae and the financials as well as an updated macro analysis on the energy complex. Subscribe here.

|

The Big Picture – August 08

The View from 30,000 Ft.

Lately, there have been many calls from monetary officials that they wish for many “walking dead’ financial institutions to ‘raise capital’ to bolster their balance sheets. With a willing and [so far] able Plunge Protection Team at the ready – some of these financings have taken place with an “air” or the appearance of success.

Others, haven't fared so well:

HBOS investors shun cashcall, $7.5 billion stock unsold

By Steve Slater

LONDON (Reuters) - An emergency fundraising by HBOS (HBOS.L: Quote, Profile, Research), Britain's biggest home lender, flopped as investors took just 8.3 percent of the shares, leaving underwriters trying to sell almost 3.8 billion pounds ($7.57 billion) of stock.

What folks should take away from this is how conflicted the “official message” of raise more capital is with financial firms’ ability to actually raise cash. As read through this report you will see just how some financials are created more equal than others.

[more.....signup] [open pdf....members] |

Making Heads or Tails of a Confused Picture

(pdf version for members)

If poor financial performance stemming from ownership of junior resource companies is getting you down – read on for some valuable insight as to remedial, insulating actions you can take now to help protect and preserve your net worth.

Understanding How and Why Metals Markets are Manipulated

The basics are these:

· A rapidly rising price of gold has historically served as the “proverbial canary in the coal mine” – alerting investors that money is being created in excess.

· This, in a nutshell, explains why gold is viewed and so widely spoken of as the “ainti-dollar”. A rapidly rising price of gold explicitly means that the purchasing power of fiat money [aka the dollar] is shrinking. As people witness, first hand, the erosion of their purchasing power – they lose confidence in the currency being debased and, they naturally seek alternatives to preserve their wealth.

· Because fiat money – backed by nothing – is, in effect, a huge exercise in blind faith - monetary authorities do go to extreme lengths to prevent the erosion or collapse of the collective faith in their brand of fraudulent currency.

· Key to their efforts – are making the historical sound alternatives look bad or worse.

· This is accomplished by capping or even pummeling the price [primarily through the use of futures (COMEX and LBMA) through surrogate conduits utilizing their puppets in the banking community (read, Goldman Sachs and J.P. Morgan)] when metals prices start to rise in earnest. This is evidenced by the staggering amounts of gold derivatives [approx. 100 billion in notional at J.P. Morgan alone] on the books of players such as J.P. Morgan [from the Office of the Comptroller of the Currency Quarterly Derivatives Report]:

The Achilles Heel

What is vitally important for everyone to realize is that the price riggers DO HAVE AN ACHILLES HEEL. While it is not readily or implicitly apparent in the table of gold derivatives above – what folks need to understand is this: For futures markets to remain viable as price discovery mechanisms, there must be the belief [or threat if you prefer] that a maturing futures contract can, in fact, be settled with the underlying physical commodity.

This implies the following: If derivatives are, in fact, being used to suppress the price of gold then ‘some amount’ or percentage of the notional being traded - of the underlying physical commodity necessarily is changing hands.

Now, consider that we factually know that physical supply of gold [mine supply + scrap] has been in an annual deficit position, relative to physical demand [jewelry and investment] of 1,000 to 1,500 tonnes per year for as minimum of the past 10 – 15 years.

There is only one source where this undisputable deficit can be [or has been] satisfied: VAULTED SOVEREIGN STOCKS OF PHYSICAL GOLD – period!

Now, folks need to understand and appreciate that Central Banks around the world have for decades claimed to posses around 30,000 tonnes of vaulted sovereign stocks of gold bullion [including 8,000 or so tonnes allegedly held by the U.S. at Fort Knox and West Point]. Despite the facts regarding annual supply/demand deficits presented above, there has been NO ADMISSIONS to changes in the amounts of physical bullion controlled by Central Banks? They still claim to have, more or less, 30,000 or so tonnes of vaulted sovereign gold.

What we do irrefutably know about Central Banks and their accounting treatment of gold stocks would, no doubt, bring a tear to Enron’s jailed former chief financial officer – Andy Fastow’s eyes. You see, we know that Central Banks “swap” and “lease” gold. When gold bullion is swapped or leased – it physically leaves the vault and is sold into the open market. The now missing physical gold is replaced with a “paper I.O.U.” and the Central Bank continues to report [can you say double-counting?] on its books that the physical bullion is STILL THERE.

Anywhere else in the world, this would be called FRAUD.

What we can take away from all of this is the following:

· Using back of the envelope math: 1,500 tonnes x 15 years = 22,500 tonnes. Then: 30,000 [alleged vaulted] – 22,500 [accumulated deficits] = 7,500 remaining vaulted tonnes.

· The 7,500 remaining vaulted tonnes may in fact be conservative.

When this relative pittance of physical gold bullion is either gone or withdrawn from possible sale – the only possible means for price manipulation will be naked selling of COMEX futures. This leg of the ongoing price manipulation would logically and likely be savage in nature – perhaps trying to inject such extreme volatility to the metals complex that folks are literally too scared to participate.

This continued fraud WILL CAGEGORICALLY HAVE A VERY SHORT SHELF LIFE – because there will be no viable physical settlement capability/mechanism to validate the futures exchange as reliable or honest price discovery. When it ends, the price of gold and precious metals will advance geometrically.

If this assessment is correct, then one would logically be led to the conclusion that shortages of physical metal should be appearing. Low and behold, this is EXACTLY WHAT IS HAPPENING:

|

Silver & Gold Shortage Announcement

Due to the recent price fluctuations, APMEX is experiencing a temporary shortage on certain popular products.

We are actively scouring our sources to locate additional inventory to satisfy the needs of our valued customers

Other firms, like Kitco, are a little more cunning in the way they convey the same message: |

|

| “IMPORTANT:Due to the volatility of the market, we are experiencing a significant increase in the volume of shipments going out. Although Kitco and our depositories are working hard to stay on top of this, you may experience a delay in your order being processed by our vault, and sent out to you. We apologize for any inconvenience this may cause, and appreciate your patience and understanding.” |

And,

*Palladium Maple 1 oz (Currently out of Stock) |

$354.00 |

So, the banner headline, at a minimum, explicitly states that demand for physical bullion is exploding and provides “cover” for shortages of any metal. Furthermore, individual products cannot be supplied but the vendor has the balls to say what they would sell them for “if they had them”.

So, please…..I’d like EVERYONE to ask themselves why the price of COMEX gold futures are really collapsing?

Everyone would do well to remember that the precious metals exchange traded funds, GLD and SLV – that claim to have real bullion backing them, with custodial arrangements that are as clear as mud - were brought to market by the same folks who own the vast majority of the open interest on the “suppressive” metals futures exchanges.

Hmmm………

This sordid game is VERY LONG in the tooth. Anecdotal accounts of physical shortages of precious metal are cropping up all over the world with increasing regularity. If you haven’t yet invested a portion of your investable assets in physical bullion – time is of the essence NOW!

The August Big Picture at Kirbyanalytics.com gives subscribers more high level macro-economic analysis, making sense of conflicted financial news reporting as well as valuable insight and knowledge as to how to go about acquiring physical precious metals. |

Dead and Buried, But Not Forgotten

(pdf version for members)

Last August the 18th – 2007, a Saturday, Catherine Austin Fitts was interviewed on COAST TO COAST AM by Ian Punnett. The subject matter was the US Tapeworm Economy & Black Budgets.

During the interview, Fitts recounted a meeting she chaired back in the late 1990’s [April of 1997]. The meeting was an advisory board meeting [for pension fund managers] sponsored by a subsidiary of her [then] company, Hamilton Securities Group. In broad terms, Fitts was lecturing the attendees as to actionable steps that might be taken to help restore financial responsibility and integrity to the financial system.

In response, Fitts revealed that a senior manager from CalPERS [California Public Employees Pension] responded to her that,

“Don’t you realize……It’s too late……..They’ve [who ever “they” are] already given up on America!” They’re moving all the money off-shore [presumably to Asia]”.

Rob Kirby was so curious just who this individual was – the dude from CalPERS who claimed to posses this knowledge – that he contacted Catherine Austin Fitts directly and asked just who this individual was?

Fitts revealed to him in writing that this “fine gentleman” was none other than Bill Crist – then president of CalPERS. In Fitts’ own words,

“In April 1997, we had an advisory board meeting at Safeguard Scientifics where the board chair led a venture capital effort. I gave a presentation on the extraordinary waste in the federal budget. As an example, we demonstrated why we estimated that the prior year’s federal investment in the Philadelphia, Pennsylvania area had a negative return on investment. It was, however, possible to finance places with private equity and then reengineer the government investment to a positive return and, as a result, generate significant capital gains. Hence, it was possible to use U.S. pension funds to increase retirees’ retirement security significantly by investing in American communities, small business and farms — all in a manner that would reduce debt and improve skills and job creation. This was important as one of the chief financial concerns in America at that time was ensuring that our retirement plans performed financially to a standard that would meet the needs of beneficiaries and retirees. It was also critical to reduce debt and create new jobs as we continued to move manufacturing and other employment abroad. If not, we would be using our workforce’s retirement savings to finance moving their jobs and their children’s jobs abroad.

The response from the pension fund investors was quite positive until the President of the CalPers pension fund — the largest in the country — said, “You don’t understand. It’s too late. They have given up on the country. They are moving all the money out in the fall (of 1997). They are moving it to Asia.” He did not say who “they” were but did indicate that it was urgent that I see Nick Brady — as if our data that indicated that there was hope for the country might make a difference. I thought at the time that he meant that the pension funds and other institutional investors would be shifting a much higher portion of their investment portfolios to emerging markets. I was naive. He was referring to something much more significant.

Additionally………………..

In June 2001 the Senate Governmental Affairs Committee, under the leadership of Senator Fred Thompson (R-TN), published its study, "Government at the Brink." [1] The study describes the failure of federal government agencies to maintain reliable financial systems and/or to publish required independent annual audited financial statements. The President's initial 2002 budget (before increases for 9-11) proposed that approximately 85% of all federal appropriations be awarded to the very same agencies the Thompson study states either (a) fail to maintain reliable financial systems, (b) fail to publish trustworthy or, in some cases, any, independent certified financial statements (as required by law), or both. [2]

Reports from sources like agency inspectors general and government whistleblowers charge that the problems are much deeper than mere accounting: they allege stolen and missing inventory (planes, tanks, etc.) and in some cases actually admit that they rely on black budget funding (i.e., funding that is "off balance sheet" and not subject to Congressional oversight). The existence of such reports requires that we ask whether the very government officials and contractors who are paid handsomely to protect and manage our resources in accordance with the law are looting the federal government.

Taken together, this insight suggests that “someone” or some group is in possession of a vast sum of [illicit “off balance sheet” perhaps?] money – so large, if moved, to do serious damage to the U.S. economy – according to someone [Bill Christ] highly qualified to have an opinion on such matters.

Catherine Fitts – a true American National Treasure of under appreciated and under recognized brilliance – caught on to “the game” of how this is done early on. Her background, which gave her the unique perspective and qualifications to understand all this, includes:

- Investment Advisor: Founder and managing member of Solari Investment Advisory Services, LLC.

- Entrepreneur: President of The Hamilton Securities Group, investment bank and financial software developer.

- Government Official: Assistant Secretary of Housing - Federal Housing Commissioner, Bush I.

- Investment Banker: Managing Director and member of the board of Wall Street firm Dillon Read & Co. Inc.

Catherine has designed and closed over $25 billion of transactions and investments to-date and has led portfolio strategy for $300 billion of financial assets and liabilities.

Catherine's experiences on Wall Street and in Wasington D.C. are chronicled in Dillon Read and the Aristocracy of Stock Profits:

"Long ago, I made a promise that I would never act against the best interests or the excellence of my own people—that I would do my best to ensure that we were worthy of the stewardship of our world and that we did our best to leave a better world for generations yet to come. To make and keep such a promise is to understand that money and position are tools, not goals, and that death is not the worst thing that can happen. Some would probably accuse me of 'fighting the tape' and not being 'good at the game.' I would tell those people that now is not the time in the history of our people for a failure of imagination."

So Where Do Vast Amounts of Illicit Money Come From?

From her investment banker’s perch with experience in both Wall Street and cleaning up mortgage fraud in Washington, Fitts realized that illegal proceeds from crime were regularly being “laundered” through Wall Street conduits.

Folks need to realize that the Federal Reserve collects and analyzes data on all macro monetary flows. What this means is this: the Federal Reserve would categorically be required to be a willing participant, or willfully negligent, if any extra-ordinarily large flows of illicit fiat money were moving through “THEIR” system without them blowing the whistle, so to speak. We know this to be fact if we are going to accept the position put forward by officialdom - that they can and did accurately ‘track’ the financial trail of minute cash advances and purchases of alleged plane hijackers, in the amounts of hundreds or thousands. Are we to believe that this can be accomplished but they are UNABLE to give us the real deal on proceeds of crime – flowing through their system - in the amounts of billions and / or Trillions? From official gov't reports:

In addition to staging actual terrorist attacks in partnership with al Qaeda, Hambali and JI assisted al Qaeda operatives passing through Kuala Lumpur. One important occasion was in December 1999-January 2000. Hambali accommodated KSM's requests to help several veterans whom KSM had just finished training in Karachi. They included Tawfiq bin Attash, also known as Khallad, who later would help bomb the USS Cole, and future 9/11 hijackers Nawaf al Hazmi and Khalid al Mihdhar. Hambali arranged lodging for them and helped them purchase airline tickets for their onward travel. Later that year, Hambali and his crew would provide accommodations and other assistance (including information on flight schools and help in acquiring ammonium nitrate) for Zacarias Moussaoui, an al Qaeda operative sent to Malaysia by Atef and KSM.25

Note the intimate detail of who exactly aid for what and when they paid for it on multiple transactions in obscure locations at obscure times!!!!!

In her book, Dillon Read and the Aristocracy of Stock Profits, Fitts chronicles a gamut of unsavory financial dealings - most dealing with the lobbying for and cleansing of globally generated narco-Dollars:

People widely regarded and understood as reputable do engage in reprehensible activities. Richard Grasso [former NYSE Chairman] hugging a FARC Commander in 1999 in a rebel village in Colombia at the time the GAO reported that FARC had assumed control of a majority market share of the Colombian cocaine trade. (Photo courtesy LaRouche Campaign)

But it was from Fitts’ time in government where she really gained a better understanding as to the level or degree of corruption and abuse of power:

As Assistant Secretary for Housing-Federal Housing Commissioner, [she] was responsible for the operations of the Federal Housing Administration (FHA), which was the largest mortgage insurance fund in the world. FHA at that time had annual originations of $50-100 billion of mortgage insurance and an outstanding portfolio of $320 billion of mortgage insurance, mortgages and properties. Leading the FHA necessitated significant understanding of how homes are built, how mortgages finance thousands of communities throughout America and how investors finance the process by buying securities in pools of mortgages. [Her] responsibilities included the production and management of assisted private housing; management of an organization of 7,000 employees in 80 offices nationwide; and development of network information systems and tools. In addition, [she] served as advisor to the Secretary of HUD on financial markets regulatory responsibilities, including the RTC Oversight Board, Federal Housing Finance Board and Home Loan Bank Board System, Fannie Mae and Freddie Mac.

When [she] told Nick Brady in 1989 that [she] was going to work at HUD, he said, “You can’t go to HUD — HUD is a sewer.” While [her] experience as Assistant Secretary cleaning up significant mortgage fraud that lost the government billions during the 1980s confirmed that HUD’s financial reputation was deserved, leading the FHA provided invaluable insight into how government management of the economy one neighborhood at a time really harms communities.

The lewd dealings that Fitts uncovered during her time in government, and later as a principal of Hamilton Securities; they centered on the fraudulent and overt abuse of mortgage bonds along with the sovereign credit of the U.S.A. Due to the dollar volumes involved – she eventually realized were operationally funding “black budgets”.

What wasn’t readily apparent to Fitts was how deep the rot was. As Assistant Secretary for Housing-Federal Housing Commissioner she had been ordered to clean this mess up and institute structural reforms so that such fraud could not happen again. It was not until after leaving government and starting her own securities firm [Hamilton] and becoming a government contractor that her life was “made a living hell”, spending thirteen years and six million dollars litigating successfully with the Federal Government who tried to refuse to pay their bills using bogus investigations as a pretext.

From all of this, one might be led to the conclusion that there are and were folks in very high places that did not appreciate successful efforts to help ensure that the Federal Mortgage Programs were run legally.

Clean operations stood in the way of a new housing bubble.

It was Fitts’ revelations and commentary regarding corruption and abuse in fixed income [mortgage bond] arena that drew the attention of Kirby’s research and interest. This was a natural since Kirby spent roughly 15 years of his working life employed in institutional sales as a money market, interest rate derivatives and bond broker. Prior to his becoming aware of her work in this area, his own proprietary forensic macro-economic research was much more focused toward irregularities and document-able Central Bank malfeasance in the global gold market.

Their two paths crossed naturally, partly due to his own brand of macro-economic research and also due to her serving as a director of GATA [short for Gold Anti-Trust Action Committee] – chaired by William [Bill] Murphy.

With sub-prime mortgages being “font and centre” in the news lately, it was no wonder that Ms. Fitts recently penned this short quip which was published at www.Lemetrolpolecafe.com:

Mortgage Market Musing

Catherine Austin Fitts

Sometimes, it helps to step back and see the big picture.

Let’s say that I serve as the depository for a large government and I also own the central bank. I get my partners appointed to run the government’s treasury and key funds on a regular basis so I can also control financial system policies and regulation that help me finance what I want to do and mess up my competitors. Even that is getting cumbersome so I am arranging to move most of the regulatory control over to my central bank because I can control all of it privately.

Frustrated with having to deal with democratic processes, I decide to move a significant amount of money out of the government between 1997 and 2001 for reinvestment abroad. I and my partners and our syndicates engineer a series of steps to bubble the economy so that when I move the money out the currency is high and because everyone was making money they did not notice that lots of capital was leaving. To ensure no one notices, I suppress the gold price which turns off the financial burglar alarm and shifts gold out of the government into my private control at below market prices.

Normally moving money out of a government in excess of the total taxes that year would be hard to do. However, I could use securities fraud. I could issue a lot more government securities and government agency (like mortgage agencies) securities than I recorded on the government books and sell them abroad. I would have to make sure not to publish audited financial statements as that would increase the liabilities of engaging in this kind of fraud. It would help a lot if I could pool mortgages and sell government agency securities to finance those mortgages in a process where the same mortgage could be sold many times into the same pool. Investors would not notice or care because the securities were government guaranteed.

I also engineer an internet and telecom stock bubble, and move trillions more out through that mechanism.

OK, so as I move the money out of the country at a high price because my currency is high, what do I invest? Well if places like Asia, Latin America and Russia experience economic crashes as a result of credit crunches that result as my cutting off credit, then their currencies will be low and they will welcome investment. Or if they don’t welcome investment, I can make sure that the IMF and World Bank can strong arm.

So I can buy in really, really cheap. Meantime, these currencies rise as I move manufacturing and jobs into the places where I now have big investment positions. So my investments go up.

Well, back in the U.S. the bubble bursts, and the institutions like Fannie and Freddie that financed the housing bubble experience significant losses. Their stocks drop by a lot. That hits the pension funds, 401ks, IRAs and other savings of the people who have lost money on their homes. It’s a double whammy. A lot of them also lose their jobs. Triple whammy.

The currency drops in value a lot. This means that the dollar I pulled out and put into other currency that has been going up, up, up, is now worth multiple dollars. As asset values drop, each remaining dollar can buy things cheaply.

Indeed, with Fannie and Freddie’s stock dropping like a stone, I could have one or more of my offshore investment vehicles fund a recapitalization plan and buy control of the senior positions directly or indirectly controlling 50% of the residential mortgages in the country with my profits — that is for a small portion of that which I shifted out of the government.

Think of it. The housing bubble has reached its logical conclusion. If you can get enough people to buy a home for no money down, you can buy their country for no money down.

Over the course of the past couple of years, a background as an interest rate derivatives [swaps] broker along with the mushrooming size of J.P. Morgan Chase’s derivatives book [high-water mark, so far, of 92+ Trillion in notional at Q3/07] – the lion’s share of it being interest rate swaps – both alarmed and garnered Kirby’s attention.

In this regard, what folks need to understand is that “if hedged” – interest rate swaps of duration between 3 and 10 years virtually always have a government bond trade imbedded in them. This raised the specter of whether or not J.P. Morgan’s 80 or so Trillion worth of Interest Rate Swaps are “hedged” or whether the institution is taking a “naked punt” of staggering proportions. The conclusion he reached after researching the topic – J.P. Morgan, through regular daily activity in their swap book, is engaged in the on-going trade of government bonds that CANNOT LOGICALLY or LEGALLY EXIST.

Rob Kirby formally presented his findings in this regard in a paper delivered at GATA’s Washington conference in April of 2008, titled, The Elephant In the Room.

Naked Short Sales [or Monetization] – More Flavors Than Ben and Jerry’s

In the mainstream financial press, of late, there has been much-ado about NAKED SHORT SALES of equities [stocks]. That these phantom stock trades do in fact occur cannot be refuted. The Securities and Exchange Commission [SEC] has not only acknowledged that these fraudulent trades do occur, although illegal, but they have even gone so far as to announce that they will be vigilant – going forward – to ensure these illegal trades do not happen to selective financial stocks.

What this shows is that regulators – in this case the SEC – do, at least on occasions - turn a blind eye to illegal actions right under their noses and certainly within their jurisdictions.

What impressed Kirby about naked short sales of equities was how similar in appearance they were with the purchase and sales of bonds – particularly in the case of J.P. Morgan Chase – that, likewise, cannot legally exist.

In the case of “phantom” stocks, laymen cannot tell the difference between real ones or the fakes. The only folks who do know the difference are the settlement agents – the DTCC [Depository Trust Clearing Corporation] – whose leadership is made up of the very firms [banks and investment firms] who perpetrate these crimes. To date, neither the DTCC nor the SEC have shown any willingness to expose the firms who have participated in these activities – citing bogus reasons of not wanting to reveal trade secrets. For all intent and purpose, the trade data is buried and will never see the light-of-day.

Folks would do well to remember the most predominant character trait of international bankers; namely, they’ve never paid allegiance to ANY nation and their conduct is best described as supra-national. History proves this point:

During the Civil War (from 1861-1865), President Lincoln needed money to finance the War from the North. The Bankers were going to charge him 24% to 36% interest. Lincoln was horrified and went away greatly distressed, for he was a man of principle and would not think of plunging his beloved country into a debt that the country would find impossible to pay back.

Eventually President Lincoln was advised to get Congress to pass a law authorizing the printing of full legal tender Treasury notes to pay for the War effort. Lincoln recognized the great benefits of this issue. At one point hi wrote:

"... (we) gave the people of this Republic the greatest blessing they have ever had - their own paper money to pay their own debts..."

The Treasury notes were printed with green ink on the back, so the people called them "Greenbacks".

Lincoln printed 400 million dollars worth of Greenbacks (the exact amount being $449,338,902), money that he delegated to be created, a debt-free and interest-free money to finance the War. It served as legal tender for all debts, public and private. He printed it, paid it to the soldiers, to the U.S. Civil Service employees, and bought supplies for war.

Shortly after that happened, "The London Times" printed the following:

"if that mischievous financial policy, which had its origin in the North American Republic, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without a debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in th history of the civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed, or it will destroy every monarchy on the globe."

The Bankers obviously understood. The only thing, I repeat, the only thing that is a threat to their power is sovereign governments printing interest-free and debt-free paper money. They know it would break the power of the international Bankers.

After this was published in "The London Times", the British Government, which was controlled by the London and other European Bankers, moved to support the Confederate South, hoping to defeat Lincoln and the Union, and destroy this government which they said had to be destroyed.

They were stopped by two things.

First, Lincoln knew the British people, and he knew that Britain would not support slavery, so hi issued the Emancipation Proclamation, which declared that slavery in the United States was abolished. At this point, the London Bankers could not openly support the Confederacy because the British people simply would not stand for their country supporting slavery.

Second, the Czar of Russia sent a portion of the Russian navy to the United States with orders that its admiral would operate under the command of Abraham Lincoln. [The Czarist regime would pay dearly for this transgression in the future.] These ships of the Russian navy then became a threat to the ships of the British navy which had intended to break the blockade and help the South.

The North won the War, and the Union was preserved. America remained as one nation.

Of course, the Bankers were not going to give in that easy, for they were determined to put an end to Lincoln's interest-free, debt-free Greenbacks. He was assassinated by an agent of the Bankers shortly after the War ended.

Thereafter, Congress revoked the Greenback Law and enacted, in its place, the National Banking Act. The national banks were to be privately owned and the national bank notes they issued were to be interest-bearing. The Act also provided that the Greenbacks should be retired from circulation as soon as they came back to the Treasury in payment of taxes.

In 1972, the United States Treasury Department was asked to compute the amount of interest that would have been paid if that 400 million dollars would have been borrowed at interest instead of being issued by Abraham Lincoln. They did some computations, and a few weeks later, the United States Treasury Department said the United States Government saved 4 billion dollars in interest because Lincoln had created his own money. So you can about imagine how much the Government has paid and how much we owe solely on the basis of interest.

Selling something that does not exist [naked shorting], besides being fraudulent, is tantamount to printing money out of thin air. Most problematic for the perpetrators, perhaps, are the paper trails generated by these larcenous transactions.

With Kirby’s background having so much to do with bonds – trading and settlement – owing to the fact that he once helped set up an institutional bond-desk, Ms. Fitts’ little vignette [especially the time frame of 1997-2000 cited] really stuck in his craw.

With the events of 9/11 being forever etched in his mind – having lost so many good friends at bond broker, Cantor Fitzgerald, the world’s largest broker of U.S. Government Securities – floors 100-105 North Tower, WTC – he happens to remember intimate details of things like, the 658 Cantor employees that died that day and how quickly the firm re-commenced operations. In case none of you remember, here’s a little refresher:

Cantor Fitzgerald Finds Permanent NYC HQ, Will Add 200 Jobs

by JACK LYNE, Site Selection Executive Editor of Interactive Publishing

NEW YORK — Cantor Fitzgerald (www.cantor.com), which suffered the most devastating corporate casualties on 9/11/01, has picked a permanent new headquarters home in New York City.

….Perhaps the most critical steps in the company’s comeback came immediately after the attacks. Somewhat miraculously, Cantor and eSpeed managed to be back up and running when the New York bond market reopened at 8 on the morning of Sept. 13 — not yet 48 hours after 9/11’s attacks.

One key recovery element was the mirror site that Cantor had established at its data center in Rochelle Park, N.J. The New Jersey operation replicated all of the machines, connections and functionality inside the company’s WTC headquarters…..

…One of the biggest assists came from rival electronic trading company ICI/ADP (www.iciadp.com). While eSpeed’s IT staff was able to restore many trading system applications, it couldn’t resuscitate the system for settling transactions — which would’ve made reopening for business impossible.

Kirby wrote to Ms. Fitts after reading her Mortgage Market Musing piece,

Catherine;

Your little story posted at the cafe about a gang of scoundrels who sold bonds that might not have existed. If I was a betting man – I’d say and in fact have no doubt that those bonds were “monetized” through Cantor Fitzgerald in the time period 1997 – 2000. Trillions were undoubtedly involved.

Best,

Rob Kirby

Whether or not Trillions of dollars worth of bonds were really “monetized” through Cantor Fitzgerald form 1997 – 2000, perhaps no one will ever really know for sure.

This tidbit [or smoking gun, perhaps?] emphatically states that Trillions worth of bonds issued “disappeared into a black hole”,

Discrepancies in America's accounts hide a black hole

`By Daniel Gros

Published: June 15 2006 03:00 | Last updated: June 15 2006 03:00

The global financial system seems to have a black hole at its centre. Over the last two decades, US residents have sold a total of about $5,500bn worth of IOUs to foreigners, yet the officially recorded net investment position of the US has deteriorated only by a little more than half of this amount ($2,800bn). The US capital market seems to have acted like a black hole for investors from the rest of world in which $2,700bn vanished from sight - or at least from the official statistics.

How can $2,700bn disappear?

It is often argued that the US can simply make large capital gains on its gross positions because its assets are denominated in foreign currency and its liabilities in dollars. However, the available data indicate that over the last two decades this factor has netted the US at most $300bn-$400bn. This still leaves a loss of well over $2,000bn to be explained…..

Ladies and gentlemen, the only way that I know that 2.7 Trillion worth of bonds can disappear – is if they were “monetized” - on the sly.

If such an event did occur, the Federal Reserve would categorically and necessarily have been aware that something was amiss - if not outright complicit in the act. That, of course, would be saying something awfully nasty about the Federal Reserve [an institution that has no reserves and is no more ‘Federal’ than Federal Express] as well as the institution of “Central Banking” now – wouldn’t it? As GATA secretary and treasurer, Chris Powell, recently wrote,

Is central banking inevitably deceitful, corrupt, and grafting?

Working with GATA, you eventually discover that you're working with not just the secret knowledge of the universe -- the power of gold -- but also and just as important the largely forgotten knowledge of the ages. A powerful reminder of this can be found in an essay written five years ago for the Mises Institute in Auburn, Alabama, by one of its adjunct scholars, H.A. Scott Trask, "The Fed's Predecessors in American History."

Trask's essay is a brief history of the Second Bank of the United States, which functioned from 1817 to 1836. Trask shows how this central bank quickly resorted to market manipulation, deceit, patronage, and corruption to maintain its power and subvert democracy. Some of the methods cited by Trask are identical to those being used now by the successors of the Second Bank of the United States, the Federal Reserve and the Treasury Department.

Trask quotes the economic historian William M. Gouge as attributing the failures of the Second Bank of the United States to the very concept of central banking. "The fault is in the system," Gouge wrote. "Give the management of it to the wisest and best men in the country, and still it will produce evil."

Each day's news out of Washington and New York makes it harder to argue with those who think so.

You can find Trask's essay at the Mises Internet site here:

http://www.mises.org/story/1395

Whether or not those towers were really brought down to obscure a number of Trillions of dollars worth of illegal money creation would certainly lend credence to the 9/11 Truth Movement – who refuse to accept – as I do – the official explanation as to how and why those towers were brought down.

One can only speculate that if such a thing ever did occur – an OBSCENCE amount of money would have been created “out of thin air” which would have been more than enough to “blow a few asset bubbles with”.

Another thing, if such an event really ever did happen, the traceable records of the phony bond trades are all buried too.

All that would remain to give anyone a sniff would be unacknowledged or reported “untraceable fiat cash” – wreaking inflationary havoc on an economy somewhere.

“We shall have World Government, whether or not we like it. The only question is whether World Government will be achieved by conquest or consent.” – James Paul Warburg, whose family co-founded the Federal Reserve - while speaking before the United States Senate, February 17, 1950

Note:

Officialdom is still trying to silence the voice of Catherine Austin Fitts. Just this week she was ‘censored’ from KPFA radio in the San Francisco Bay area where Fitts had been doing a 15 minute segment once a week called "Community Business" on Flashpoints, a show on KPFA which is a Pacifica affiliate.

Fitts was offered this as an explanation, “that only academics and not for profits may be allowed on Flashpoints to cover economic issues. That means no investors, no business people including small business people or independent small investors”.

As a result, the show host, Dennis Bernstein, has requested that Project Censored investigate.

For more on Ms. Fitts' theory that covering up $4 trillion missing

from the US Treasury was an essential part of the 9-11 operations, see:

9-11 Profiteering

http://www.scoop.co.nz/stories/HL0403/S00244.htm

Will the Real Economic Hit Men Please Stand Up?

http://www.scoop.co.nz/stories/HL0503/S00090.htm

The Most Profitable Economic Hit in History

http://www.solari.com/blog/?p=978

Rob Kirby on Central Banking

http://www.financialsense.com/fsu/editorials/kirby/2006/0510.html |

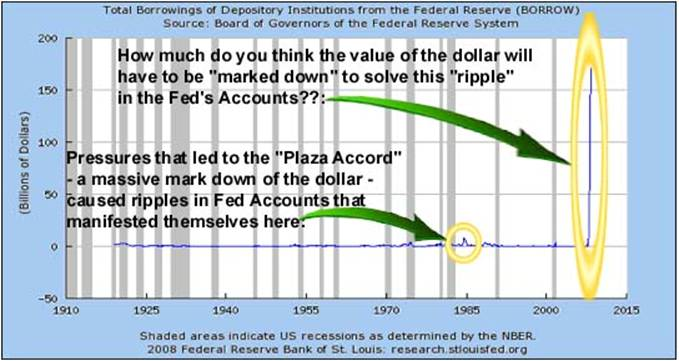

China’s Coming Out Party

The Plaza Accord or Plaza Agreement was an agreement signed on September 22, 1985 at the Plaza Hotel in New York City by 5 nations - France, West Germany, Japan, the United States and the United Kingdom. The five agreed to, amongst others, depreciate the US dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets. [more.....signup] [open pdf....members] |

The Engine Room of American Monetary Policy

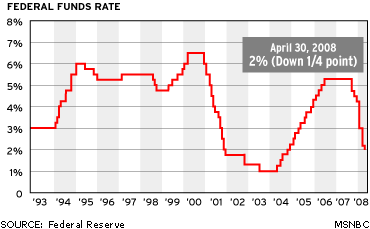

Who hasn’t heard of the Federal Reserve’s vaunted interest rate policy group, the FOMC? We’re all aware that this group is constituted of Fed Governors who meet every-so-often and at the conclusion of their meetings make an “announcement” regarding their target for short term interest rates or the Fed Funds Rate. Accompanying the decision on interest rates, there is typically a simultaneous release, or statement, espousing the views of the governors who make up the FOMC – which is short for Federal Open Market Committee.

It is generally accepted that the Fed then utilizes Open Market Operations, generally conducting billions in temporary [TOMO] or permanent [POMO] to direct or implement their policy decisions.

So far, so good – right? [more.....signup] [open pdf....members] |

Bootlicks For Bankers

Just this week we heard from the head of the SEC, Christopher Cox, that “naked shorting” of financial stocks would not be tolerated.

Absolutely bloody amazing!

In case anyone is unaware, naked shorting of ANY stock is basically supposed to be illegal in the first place,

Naked short selling involves selling stock without first borrowing (or

sometimes even locating) the stock. If a naked short seller does not

borrow the stock he sold, he will be unable to deliver that stock to

the buyer to close the transaction. This is called a "failure to

deliver" (FTD). Naked short selling is generally illegal, though

market makers are allowed to temporarily naked short for the sake of

bona fide market making. FTDs are always illegal when delivery failure

exceeds 13 days. [more.....signup] [open pdf....members] |

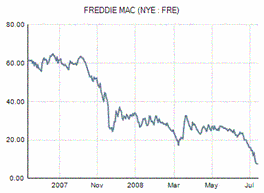

50 Ways to Leave Your GSE

First, let’s slip out the back, Jack, and try to wrap our heads around the unfolding situation. Last week, spooked investors ‘got off the bus, gus’ sending the share prices of Fannie Mae [FNM] and Freddie Mac [FRE] down more than 45 % on the week and more than 75 % on the year.

Fannie Mae and Freddy Mac play a central role in the U.S. housing finance industry because they provide a crucial source of funding for banks and other home lenders, especially since the advent of the sub-prime credit market crisis that appeared last summer.

[more.....signup] [open pdf....members] |

Chart Analysis

I’ve taken data from the latest Office of the Comptroller of the Currency – Quarterly Derivatives Report [Q1/08 just released a week ago]. I’ve done some comparisons of the same selected data Q4/07 vs. Q1/08. There are/were some interesting developments.

[more.....signup] [open pdf....members] |

Attraction Is In the Eye of the Beholder

While I will never be accused of agreeing with Professor A. Fekete on every point he makes, as a proponent of sound money, his is a voice that deserves to be heard. Thus, I was saddened to hear that Professor Fekete’s Gold Standard University Live was losing the support of its “angle investor” Eric Sprott as a source of funding:

Mr. Eric Sprott said in his letter that "we weren't attracting enough interest to justify that ongoing expenditure".

I have no idea to what extent Gold Standard University Live was being subsidized, but what I can say is this; promotion/education of the true state of our current financial system, which is seriously broken – and discussion regarding practical alternatives - is vital.

What I found particularly disturbing, was the manner in which Professor Fekete summed up the reasons for his effort’s perceived failure:

“To give you an idea of the odds I am facing let me quote from the article in Wikipedia (June 9, 2008) captioned under my name: “It should be noted that mainstream economic theorists criticize gold standard-oriented monetary economists and monetary reformers such as Professor Fekete as ‘fringe’ or ‘amateur’ economists, not worthy of serious study. Professor Fekete has never held a teaching position in the economics department of any prominent university”.

As a researcher/writer myself – one who shares many of the same core values as Professor Fekete – I’ve all-too-often heard the same commentary from ‘mainstream’ analysts and the mainstream financial press – that my work was too conspiratorial or even kooky - and only had appeal to like minded conspiracy theorists or kooks. In short, his cause is the same as mine.

Since the nature of my research is best described as both forensic and macro-economic, I can personally attest and am pleased to provide – through ‘mining’ data from my own web-log [kirbyanalytics.com] – a list of kooky institutions that have read at least one of my articles and visited my web site over a recent 3 month period. You see folks, when these entities visit my web site – they leave an electronic ‘foot print’ or their URL in my web log statistics.

[more.....signup] [open pdf....members] |

Benedict Benjamin Bernanke